Nvidia H20 Chip Sales to China Resume After U.S. Approval: A Game-Changer in Global AI Competition

In a significant move that could shift the landscape of global artificial intelligence (AI) development, Nvidia has received approval from the U.S. government to restart sales of its H20 AI chips to China. This decision marks a notable moment in the ongoing balance between tech innovation and national security, as the U.S. walks a tightrope between safeguarding sensitive technology and maintaining its dominance in the global semiconductor market.

This article explores the implications of this approval, Nvidia’s strategic position, market reactions, and how this development affects global AI competition.

What Is the Nvidia H20 Chip?

The Nvidia H20 chip is part of the company’s high-performance AI hardware lineup, designed specifically to power complex machine learning models, including large language models and generative AI platforms. It’s a tailored version of Nvidia’s powerful H100 and H200 chips, adjusted to comply with U.S. export regulations for restricted regions like China.

While less powerful than its global counterparts, the H20 is still a robust solution for training and deploying enterprise-grade AI applications—making it highly sought after by Chinese tech firms.

Why Were Nvidia’s Chip Sales to China Blocked?

In 2022 and 2023, the U.S. Department of Commerce implemented strict export restrictions on high-end semiconductors and AI hardware destined for China. The goal was to limit China’s access to powerful AI technology that could potentially be used for military development or surveillance operations.

These restrictions initially impacted Nvidia’s A100 and H100 chips. To stay in the Chinese market, Nvidia developed modified versions like the A800 and H800. However, even these were eventually restricted. The H20 chip was then created to remain within U.S. export compliance guidelines, but its clearance had remained uncertain—until now.

U.S. Government Approves H20 Sales: What Changed?

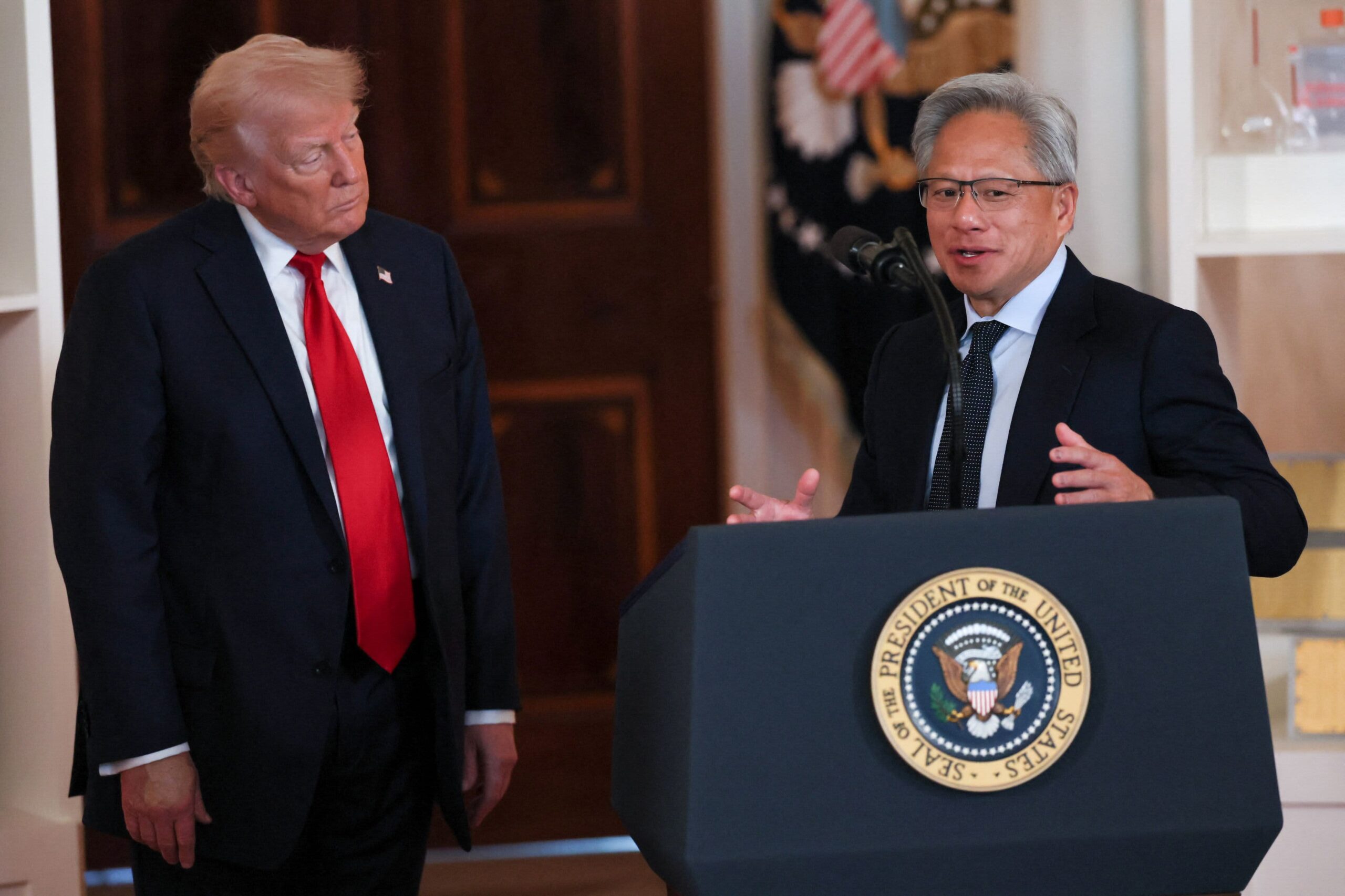

On July 14, 2025, Nvidia announced that it had received the green light from the U.S. Bureau of Industry and Security (BIS) to begin selling H20 chips to customers in China. This approval follows a comprehensive review that determined the chip meets all compliance criteria and poses minimal national security risks.

By allowing Nvidia to sell the H20, the U.S. government appears to be pursuing a more strategic approach—allowing controlled access to technology without completely cutting off American companies from major international markets.

Why This Approval Matters

1. Nvidia Reclaims Access to a Massive Market

China is one of the world’s fastest-growing markets for artificial intelligence applications. From facial recognition and financial analytics to autonomous vehicles and smart cities, the demand for AI processing power is surging.

With this approval, Nvidia can tap back into a market worth billions of dollars, regaining lost revenue and cementing its leadership position in the AI chip sector.

2. Signals a Policy Shift

This decision also hints at a potential shift in U.S. tech export policy—away from blanket restrictions and toward a more nuanced approach. By selectively allowing specific chips like the H20 to be sold, the U.S. can control technology flows while still keeping American firms competitive.

3. Impacts the Global AI Arms Race

China has been racing to build its own AI capabilities. U.S. restrictions had pushed many Chinese firms to seek domestic or alternative sources. Nvidia’s return to the market could slow China’s shift to local chipmakers, preserving U.S. influence over global AI infrastructure.

Reaction from Chinese Tech Firms

Chinese technology giants like Alibaba, Tencent, and Baidu have reportedly resumed talks with Nvidia to place large orders for the H20 chips. These companies had delayed infrastructure upgrades due to uncertainty around chip availability.

With the ban now lifted, Chinese cloud and AI service providers are expected to invest heavily in new infrastructure, supporting the next wave of AI applications including generative AI, speech recognition, and autonomous systems.

What This Means for Nvidia

The approval is a strategic win for Nvidia at a time when global chip competition is at an all-time high. The company has been adapting rapidly to regulatory changes, showcasing its ability to innovate under constraint.

Here’s how Nvidia is likely to benefit:

-

Revenue Recovery: Sales from China had dipped due to export restrictions. H20 shipments will boost quarterly revenue.

-

Investor Confidence: The stock market responded positively to the news, with analysts upgrading Nvidia’s earnings projections.

-

Strengthened Market Position: By balancing compliance with innovation, Nvidia demonstrates its capability to serve global markets under complex geopolitical conditions.

Market Reaction and Stock Performance

Nvidia’s shares rose by nearly 4% in post-market trading after the announcement. Analysts from firms like Goldman Sachs and Morgan Stanley praised Nvidia’s regulatory navigation and market adaptability.

Experts believe the resumption of Chinese sales could add $2–$3 billion in revenue over the next 12 months, assuming demand remains strong.

Challenges and Risks Ahead

While this is a positive development, Nvidia and the U.S. government still face several challenges:

-

Policy Reversal Risk: Export rules can change quickly. Any geopolitical escalation between the U.S. and China may result in renewed bans.

-

Chinese Competition: Firms like Huawei are accelerating their chip development. Nvidia cannot rely solely on past dominance.

-

Demand Volatility: Macroeconomic conditions or regulatory changes in China could impact enterprise spending on AI infrastructure.

Expert Views

-

Wedbush Securities: “This is a smart pivot by the U.S. to retain leadership while managing security.”

-

JPMorgan Chase: “Nvidia’s long-term position in AI remains unrivaled, and this approval enhances their global growth strategy.”

-

Counterpoint Research: “Expect other firms like AMD to follow Nvidia’s footsteps in developing compliant chips.”

FAQs on Nvidia H20 Chip Sales to China

Q1. What is the Nvidia H20 chip used for?

The H20 chip is designed for AI workloads, including machine learning, natural language processing, and data analytics.

Q2. Why did the U.S. restrict Nvidia’s chips earlier?

To prevent China from acquiring powerful AI tools that could be used for military or surveillance applications.

Q3. Is the H20 chip less powerful than the H100?

Yes, the H20 is a modified version built to meet export control standards. It offers solid AI performance without breaching compliance limits.

Q4. Does this mean other AI chips can now be sold to China?

Not necessarily. Each chip is reviewed separately. Only chips that meet U.S. criteria will be allowed for export.

Q5. How does this impact Nvidia’s revenue outlook?

Analysts expect a noticeable revenue bump due to renewed Chinese demand for H20 chips.

Conclusion: A Strategic Win for Nvidia and Global Tech Stability

The U.S. government’s approval for Nvidia to resume H20 chip sales to China is more than a commercial decision—it is a calculated move in the ongoing global technology battle. For Nvidia, this opens the doors to a critical market. For China, it restores access to powerful hardware needed for its AI ambitions.

The decision also sets a global precedent for how democracies can manage technology exports while keeping their innovation ecosystem intact.

As the world watches how this unfolds, one thing is clear: AI competition is now just as much about diplomacy as it is about data.

About TOD News Desk

TOD News Desk is a team of dedicated digital journalists who specialize in breaking down complex news across business, tech, and markets into simple, insightful stories. Our mission is to help readers stay ahead with timely, accurate, and helpful updates that matter.

Suggestions: Smartworks Coworking Spaces IPO GMP: Mixed Signals Despite Strong Subscription

Source: WSJ

One Comment