Trump Tariffs Boost Indian Textile Stocks – Who’s Gaining Big?

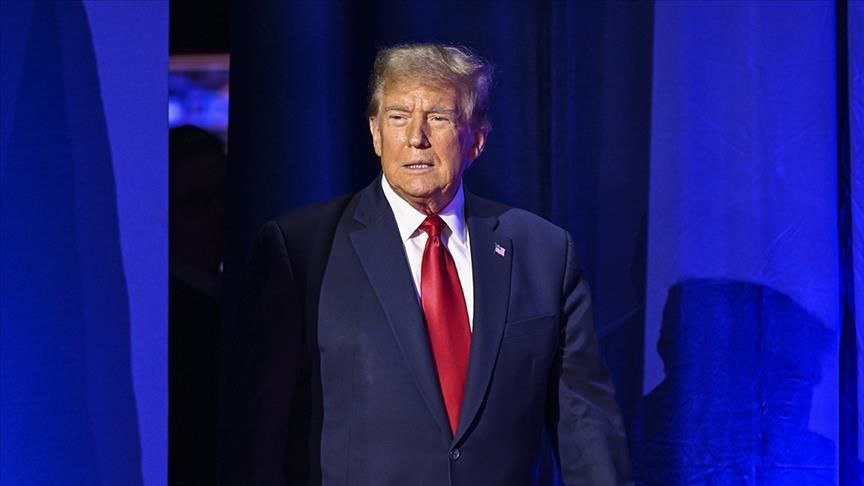

In a sudden geopolitical twist, Indian textile stocks Trump tariff impact has emerged as a major theme in the markets this week. With the announcement of a 35% tariff on Bangladeshi garment exports by former US President Donald Trump, Indian apparel and textile companies are seeing a sharp boost in investor confidence.

On July 10, shares of Indian textile exporters surged up to 8%, reflecting growing optimism about India’s chances to capture a larger portion of the US apparel market. For years, Bangladesh has dominated the low-cost garment export segment. But this sudden imposition of tariffs has altered the playing field overnight—making Indian exporters more competitive, especially in categories like cotton garments and knitwear.

So, what does this mean for Indian textile firms, global trade flows, and the stock market? Let’s explore the shift in dynamics and which companies stand to gain the most.

📈 A Market Shake-up: Tariffs Tilt the Game

The headline-grabbing announcement came as part of Donald Trump’s renewed push for economic protectionism. In his latest campaign message, Trump proposed a sweeping 35% tariff on garment imports from Bangladesh, citing trade imbalances and national interests.

While the decision has sparked diplomatic concerns, the market reaction in India has been decisively positive. Companies like Gokaldas Exports, Vardhman Textiles, KPR Mill, and Siyaram Silk Mills saw sharp increases in stock price following the announcement.

Why? Because Bangladesh has been a key supplier of readymade garments to the United States. With tariffs now inflating their export prices, buyers are expected to turn toward alternative sourcing hubs—and India is among the top contenders.

This is where the Indian textile stocks Trump tariff story begins to unfold as a strong medium-term opportunity for both businesses and investors.

👕 Why Indian Textile Stocks Are Rallying

Indian textile companies are already well-established in international markets. However, price-sensitive competition from Bangladesh and Vietnam had limited their expansion in the US.

Now, with a cost disadvantage hitting Bangladeshi suppliers, Indian exporters are suddenly looking attractive. Unlike structural overhauls or marketing campaigns, this shift is external and immediate, driven by trade policy rather than internal change.

Key reasons why Indian textile stocks Trump tariff policy is triggering bullish sentiment:

-

Improved cost competitiveness without altering production processes

-

Shorter lead times and diversified product portfolios in Indian firms

-

Strong compliance track records that global buyers prefer

-

US buyers already seeking alternatives post-announcement

Together, these factors make Indian textile firms prime beneficiaries of the new trade scenario.

🧠 Analyst Insights: “This Could Be a Game-Changer”

Brokerages and analysts have been quick to highlight the significance of the development. Many believe that the Trump tariff will trigger a shift in global sourcing strategies, particularly in the cotton garments and knitwear segments where India already holds production strengths.

A senior analyst at a leading brokerage firm noted:

“If the 35% tariff is implemented and sustained, we may see a structural shift in US apparel sourcing. Indian textile companies, especially those with export readiness and US-facing portfolios, are likely to gain long-term orders.”

In fact, several sources report that global buyers have already begun renegotiating contracts with Indian garment exporters in anticipation of tighter Bangladesh access. This proactive movement could lead to a steady inflow of new orders over the next few quarters.

This is what makes the Indian textile stocks Trump tariff shift not just a knee-jerk stock rally, but possibly the start of a multi-year rerating for the sector.

🌍 Global Trade Implications: India Steps In

Bangladesh has historically been a go-to partner for large US retailers due to its low labor costs and large production base. But tariffs of this magnitude could drive many buyers to diversify.

Here’s where India gains an edge:

-

Robust textile ecosystem: from raw cotton to finished apparel

-

Stable government policy: with PLI schemes and export incentives

-

Strong infrastructure and logistics upgrades

-

Growing use of technology in production and quality control

All these factors make India a natural alternative. As brands seek to mitigate risk from single-country sourcing, the long-term impact of Trump tariffs on Indian textile stocks could be substantial.

💰 Which Stocks Are Benefiting?

As of now, the biggest gainers from this development include:

🔹 Gokaldas Exports

Heavily focused on the US market, the company surged nearly 8% after the announcement. With strong infrastructure and compliance practices, it is expected to capture diverted demand.

🔹 Vardhman Textiles

A vertically integrated player with a strong cotton garments portfolio. Its robust supply chain and global presence make it a favored pick among institutional investors.

🔹 KPR Mill

Known for quality and scale, KPR Mill is set to benefit from new order flows, particularly in the knitwear and casualwear categories.

🔹 Siyaram Silk Mills & Welspun India

Diversified exposure in both domestic and international markets positions these companies well in a post-tariff environment.

These companies are now in focus, as investors re-rate Indian textile stocks Trump tariff beneficiaries for their near-term order growth and long-term structural opportunity.

📊 Stock Market View: Short-Term Spike or Long-Term Shift?

While the initial price action in textile stocks has been sharp, the real question is whether this can sustain or accelerate.

Market experts believe this is not a one-off rally. If the US administration follows through with tariff enforcement, the advantage for Indian players could be long-lasting, especially if:

-

India executes timely deliveries

-

Firms scale up production to meet demand

-

Competitive pricing is maintained despite rising raw material costs

That said, there are also risks. Political dynamics could change. Tariff policies could be revised. And Indian companies need to ensure they don’t overpromise on timelines or pricing.

Still, the Indian textile stocks Trump tariff surge reflects more than just news-based enthusiasm—it reflects real, quantifiable advantages for Indian exporters.

🧩 What Should Investors Do?

For those tracking the sector, this may be an ideal time to:

-

Identify fundamentally strong companies with US exposure

-

Look for firms with healthy balance sheets and efficient operations

-

Watch for quarterly results that reflect order book expansion

-

Avoid over-leveraged players chasing temporary gains

If this trend sustains, Indian textile exporters may become multi-bagger opportunities over the next few years—not just in stock returns but in global brand equity.

✅ Final Thoughts: India’s Textile Moment?

The latest trade twist is reshaping global apparel sourcing—and India finds itself on the favorable side of this shift. With Bangladeshi exporters facing cost disadvantages and the US market seeking alternatives, Indian textile firms are stepping into the spotlight.

While uncertainties remain around implementation and political stability in the US, the opportunity is real—and the response from Indian exporters has been immediate.

If execution matches expectation, the story of Indian textile stocks Trump tariff gains could become one of the defining investment narratives of 2025.

Source: ET Markets

Suggestions: IT Stocks Offering Highest Dividends in a Decade – Should You Buy Now?

One Comment